Quicken® for Mac 2017 helps you plan for today and tomorrow. Stay on top of spending by importing transactions from multiple financial institutions and categorizing them all in one place, create a budget that keeps you on track today and manage investments for the future. Now with more powerful mobile app for 2017.

FEATURES:

Key Benefits:

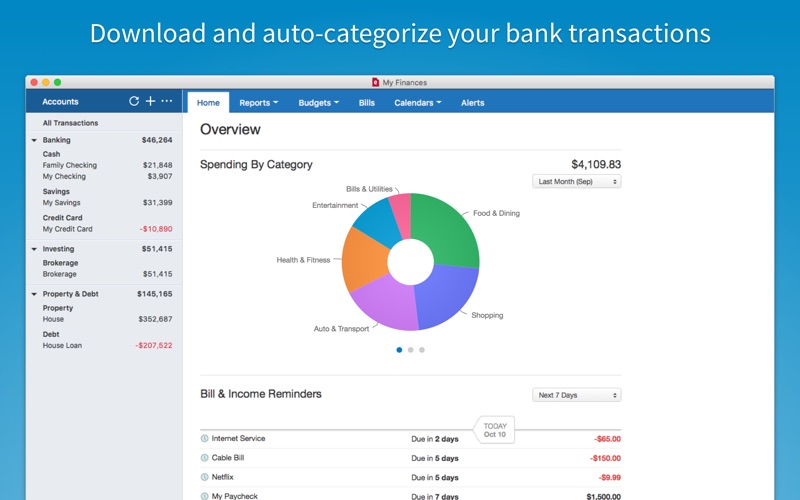

• Import all your bank transactions safely and automatically. (1)

- No need to jot it all down or save receipts.

- Includes transactions from your checking, credit card, loan, investment and retirement accounts. (1)

• Categorize all your transactions so you can see where your money is going.

- Know how much you’re spending without jumping from website to website to add it all up. (1)

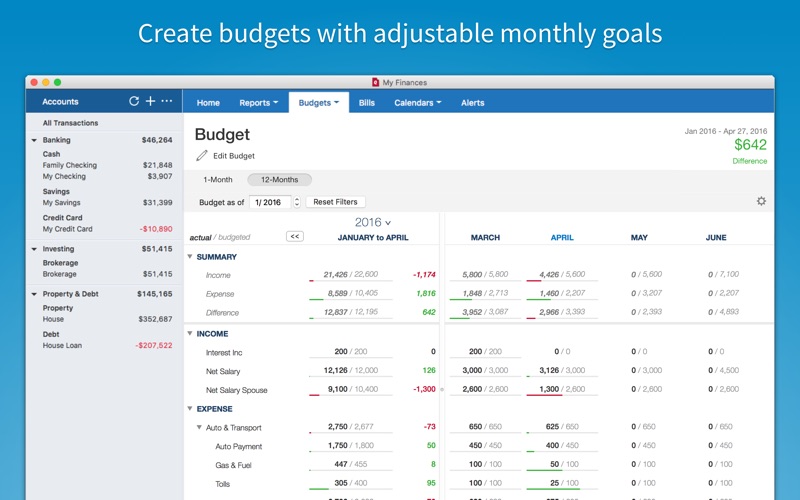

• Stay on top of your spending.

- Create a budget based on your past spending, with the flexibility to adjust goals month-by-month.

- See how much you’ll have left to spend after your bills are paid.

- Set reminders for your bills and pay them directly from Quicken, too. (3)

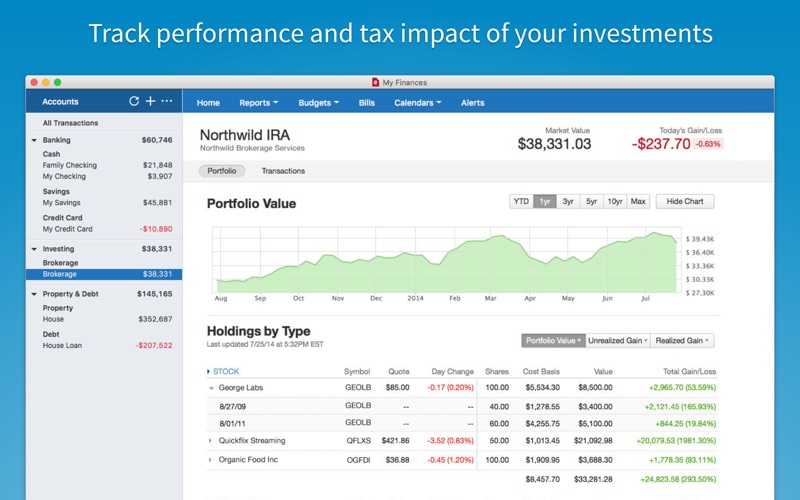

• Maximize your investments

- See how your investments are performing relative to the market for more informed buy/sell decisions.

- See realized and unrealized gains and continually updated quotes.

- Make tax time easier by tracking your deductions and creating reports.

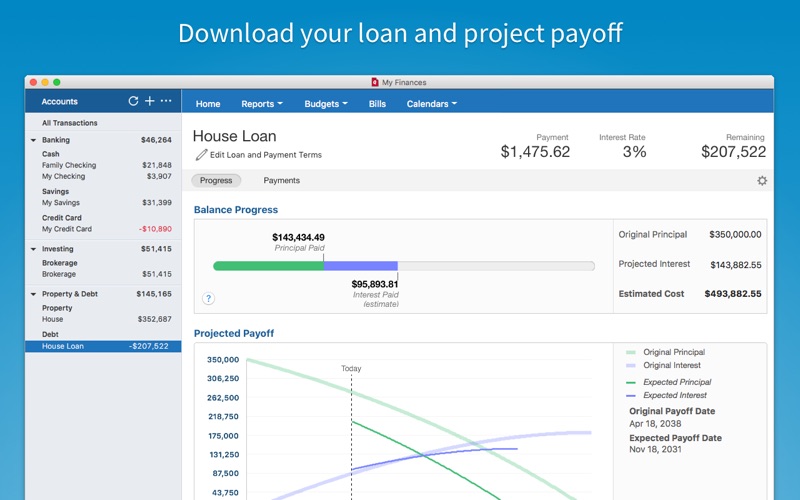

• NEW – Now supports loans.

- Track principal and interest using scheduled transactions.

- See charts of total principal and interest over time.

- Get a custom amortization table based on your loan details.

• Manage your money whenever, wherever with our mobile app. (2)

- Our mobile app is available for iPhone, iPad and Android

- Check your budget, account balances and investments

• Be confident your information is secure.

- We protect your financial information using robust 128-bit and 256-bit encryption.

• Count on us every step of the way.

- Free phone support available Monday to Friday 5am to 5pm PST or reach us on-line via our 24-hour live chat support.

IMPORT DATA FROM SOME PREVIOUS QUICKEN VERSIONS

Easily import data from Quicken 2007, and Quicken for Mac 2015 & 2016, and Quicken Windows 2010 or newer versions.

To learn how Quicken protects your privacy, please visit page www.quicken.com/privacy

By downloading this product, you acknowledge you’ve read and agree to Quicken End User License Agreement and Quicken’s discontinuation policy accessible on this page.

(1) Data download from participating financial institutions or other parties are available until April 2020; customer phone support, online features and services vary, require Internet access and/or may be subject to change, application approval, fees, additional terms and conditions. 15,000+ participating financial institutions as of 10/1/2016.

(2) Standard message and data rates may apply for sync, e-mail and text alerts. Visit www.quicken.com/go/apps for details. Quicken app (“App”) is compatible with iPad, iPhone, iPod Touch, Android phones and tablets. Not all Quicken desktop features are available in the App. The App is a companion app and will work only with Quicken 2014 and above desktop products. Earlier versions of the App prior to Quicken 2014 will not work with Quicken 2015 through 2017 desktop products.

(3) Paying bills with Quicken is available only if you have Quicken Bill Pay (Bill Payment Services provided by Metavante Payment Services, LLC) or if your bank allows you to access their bill pay product through Quicken. Application approval, fees, and additional terms and conditions may apply.